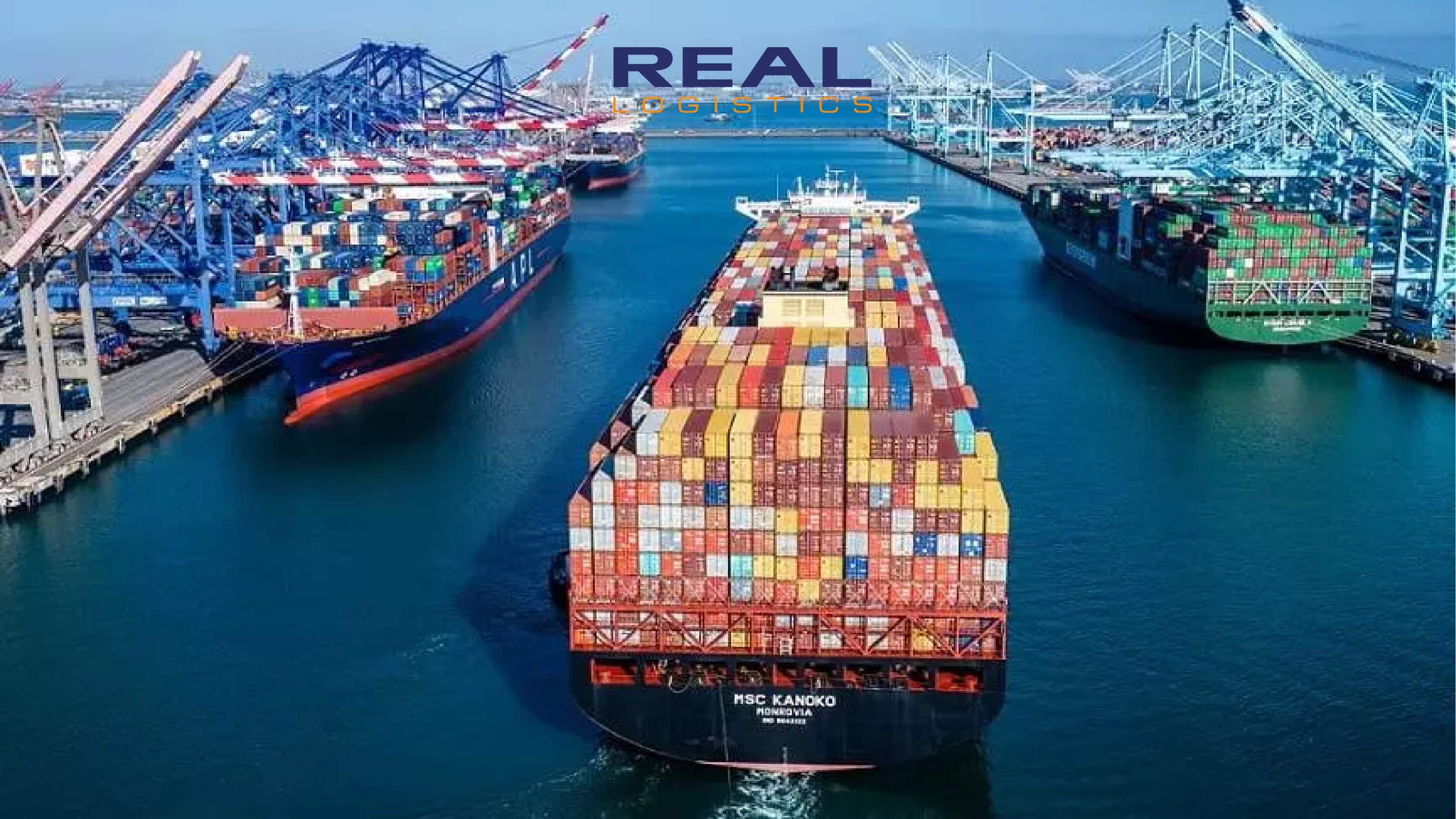

US Ports Surge in Early 2025: New York-New Jersey Leads While LA and Long Beach Regain Momentum

1. US Container Imports Surge in Early 2025 Amid Tariff Fears

The US logistics landscape saw a dramatic boost in container imports in the first months of 2025, driven largely by tariff concerns and a rush to stock inventory. According to the May Global Shipping Report by Descartes, April imports reached over 2.4 million TEUs, marking a 9.1% year-on-year increase and one of the strongest Aprils on record.

Behind the numbers is a clear sense of urgency: US importers accelerated orders ahead of a steep 145% tariff on Chinese goods, enacted on April 9. This wave of "frontloading" is reshaping port dynamics nationwide.

2. Port of New York and New Jersey: Q1 Leader in Loaded TEUs

Amid this surge, the Port of New York and New Jersey stood out as the nation’s top performer in loaded TEUs. In March 2025 alone, the port processed 516,757 loaded containers — a 9.7% increase compared to March 2024. Total volume for the month hit 783,732 TEUs, pushing Q1 volume to 2.2 million TEUs, up 10% year-on-year.

- Imports rose 8.1% in March to 381,791 TEUs

- Exports surged 14.5% to 134,966 TEUs

- Rail traffic climbed 11.9%, supporting inland distribution

- Auto throughput rose 17% for March, though Q1 auto volumes fell 10% overall

With its strategic location and robust rail infrastructure, New York-New Jersey remains a critical hub for East Coast trade, especially in the automotive and retail sectors.

3. April Rebound: LA and Long Beach Ports Reclaim Volume

While New York dominated Q1, April’s momentum shifted toward West Coast gateways. The ports of Los Angeles and Long Beach saw volumes jump by 13.9% and 12% respectively — a sign of renewed preference for faster Trans-Pacific routes amid urgent shipments.

Conversely, East Coast ports such as Savannah and Charleston reported volume declines, underscoring a tactical rerouting by shippers to meet tight delivery timelines. Although March saw East Coast dominance, April’s data signals a balancing act between coastlines based on speed, congestion, and policy shifts.

4. Sourcing Shifts: China Dominates, But Alternatives Rise

Despite looming tariffs, China remained the top US supplier, accounting for one-third of all inbound volume, led by sectors like furniture, plastics, and machinery—all targets of the recent tariff hike. However, diversification is clearly underway:

- Vietnam: +32.5% YoY

- Italy: +29.9% YoY

- Thailand: +13.4% YoY

These numbers suggest importers are seeking alternatives to mitigate geopolitical risks while maintaining supply continuity.

5. What’s Next for Shippers and Logistics Providers?

With port trends shifting monthly and trade policies evolving quickly, businesses must:

- Plan shipments proactively to avoid tariff-related delays and cost spikes

- Diversify supplier networks beyond traditional sourcing markets

- Stay agile with routing strategies, balancing West Coast speed vs. East Coast stability

- Partner with experienced logistics providers who can adapt fast and navigate complex customs scenarios

The first quarter and early second quarter of 2025 are redefining container logistics in the US. With New York-New Jersey breaking volume records and LA/Long Beach staging a comeback, shippers must stay informed, flexible, and ready to pivot. The winners in this landscape will be those who move quickly, think globally, and act locally.

—————————————

Real Logistics Co.,Ltd

👉 Facebook: Real Logistics Co.,Ltd

☎️ Hotline: 028.3636.3888 | 0936.386.352

📩 Email: info@reallogistics.vn | han@reallogistics.vn

🏡 Address: 39 - 41 B4, An Loi Dong, Thu Duc, HCM City

51 Quan Nhan, Nhan Chinh, Thanh Xuan, Ha Noi City