Import Procedures and Process for Confectionery

In addition to exported Vietnamese confectionery, imported confectionery is increasingly popular and widely used on all occasions in Vietnam. Especially during the Tet holiday season, the demand for confectionery in the domestic market rises significantly. As a result, confectionery imports, along with other food items, become more active than ever. To ensure smooth customs clearance, let’s explore the detailed customs declaration process and some important notes regarding this product with Real Logistics!

1. Legal Regulations on Confectionery Imports

Confectionery is not on the list of goods prohibited from being imported into Vietnam, so businesses can follow standard import procedures. Before proceeding with the import, you should be familiar with the following legal bases:

- Law on Food Safety No. 55/2010/QH12 issued by the National Assembly on June 17, 2010.

- Government Decree No. 15/2018/ND-CP issued on February 2, 2018: Providing detailed regulations for implementing certain provisions of the Law on Food Safety.

- Circular No. 38/2015/TT-BTC issued by the Ministry of Finance on March 25, 2015: Providing regulations on customs procedures, supervision, and inspection, as well as tax policies for export-import goods in Vietnam.

2. HS Codes and Import Taxes for Confectionery

2.1 HS Codes for Confectionery

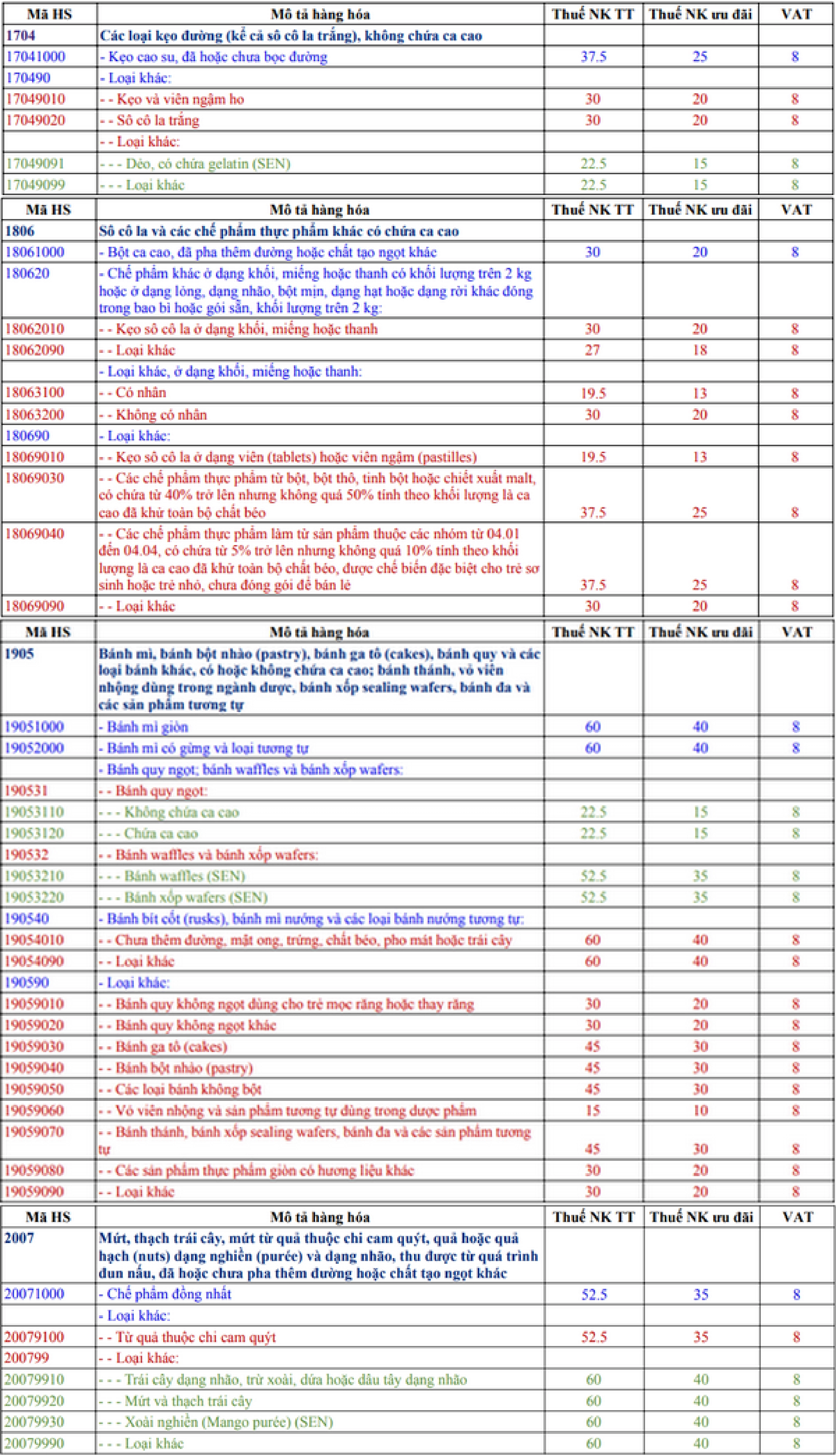

Based on their composition, characteristics, and structure, imported confectionery is classified into different types with corresponding HS codes. By identifying the correct HS code, businesses will be able to understand the applicable tax policies and regulations. Real Logistics provides you with the HS codes for confectionery as follows:

2.2 Import Taxes for Confectionery

When importing confectionery, importers must pay both import tax and Value Added Tax (VAT) at 8%.

The current preferential import tax rate for confectionery and jams ranges from 13% to 40%, depending on the HS code.

3. Confectionery Import Procedures

3.1 Import License for Confectionery

Confectionery is a packaged and labeled food product, usually intended for immediate consumption or further processing. Due to its specific nature, confectionery imports must comply with food safety regulations. For confectionery imports, it is necessary to register for an inspection (unless exempt under Article 13 of Decree 15/2018/ND-CP and point d, Clause 2, Article 41 of Decree 85/2019/ND-CP). Once the product passes, a certificate confirming the product meets import safety requirements will be issued.

Required documents:

- Import food inspection registration form

- Self-declaration of the confectionery product

- Copy of the packing list.

3.2 Food Safety Quality Inspection for Imported Confectionery

This is a mandatory step for completing customs clearance for confectionery imports.

Step 1: Prepare the following documents:

- 2 copies of the registration form with signature stamps

- 1 copy of the invoice

- 1 copy of the packing list

- Self-declaration and test reports for each product, with signature stamps

- Customs declaration form: signed on the first page with a stamp

- Introduction letter.

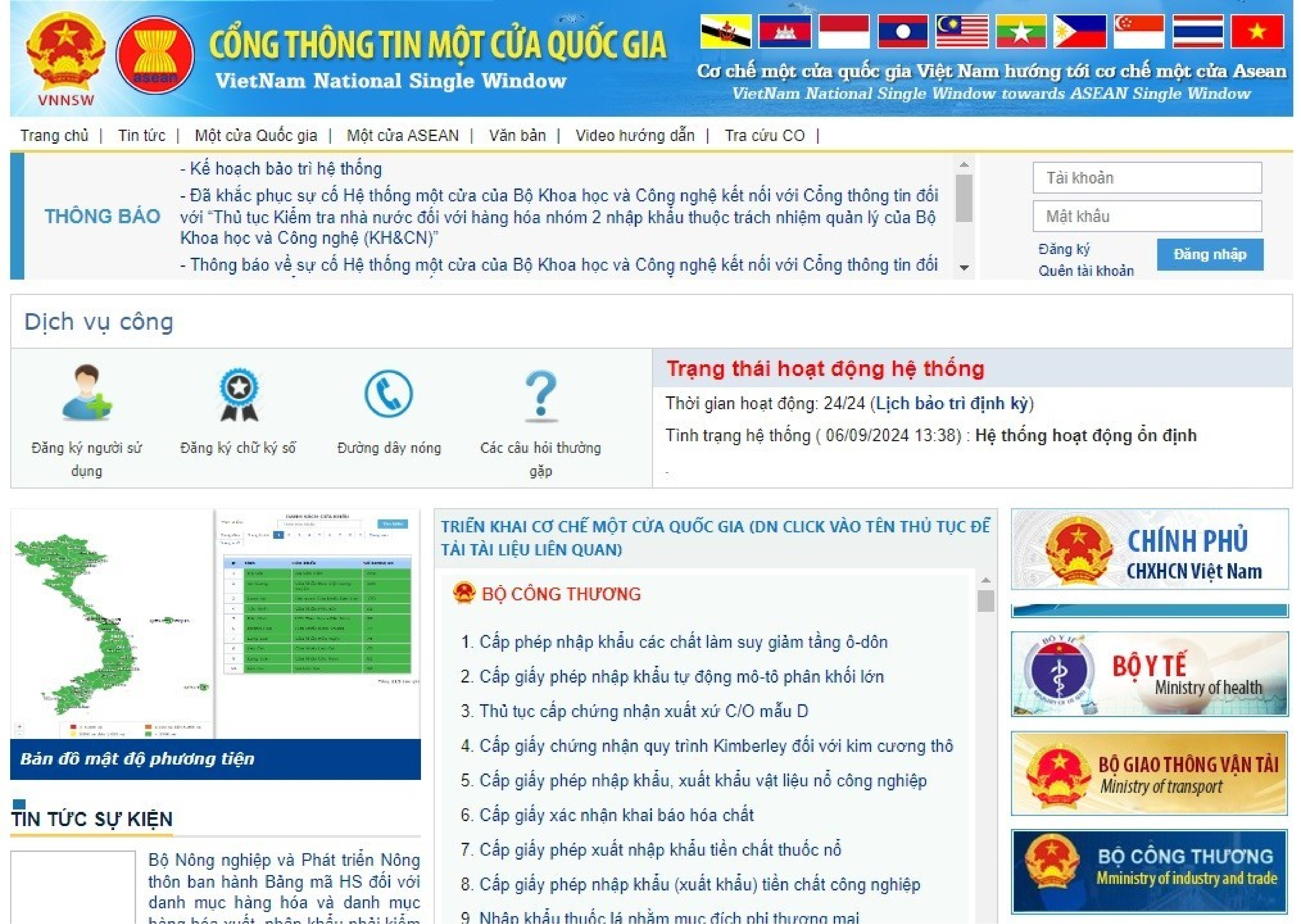

Step 2: Register for state inspection on the national single window portal – “https://vnsw.gov.vn/” immediately after opening the customs declaration.

Step 3: Submit paper documents in the required quantities to the designated state inspection agency. There are two types of inspections: standard and strict:

- If the product falls under strict inspection, the authority will stamp the documents for customs clearance, allowing you to open the customs declaration and take samples at the port for testing. Once passed, the authority will issue a certificate confirming the result.

- For standard inspection, the authorities will review the documents and issue a certificate confirming the result. You can then submit the documents to customs officers at the port/airport/customs branch where the declaration was filed.

4. Opening the Electronic Customs Declaration

4.1 Required documents:

- Contract

- Invoice

- Packing list

- Self-declaration of the imported confectionery

- Airway bill/Seaway bill

- Vietnamese name and product specifications

- Product HS code.

4.2 Submitting the declaration via the electronic customs declaration software

Currently, to complete customs clearance for confectionery or any other products, you must submit the declaration electronically, enabling customs authorities to process and resolve it on the system.

5. Confectionery Import Process

Step 1: Import a sample for testing, then complete the self-declaration of food safety with the Department of Industry and Trade or the local Department of Health.

Step 2: When the goods arrive, register for state quality inspection, submit the documents to customs to bring the goods to the warehouse for storage.

Step 3: Take samples for quality testing. If the food meets the requirements, the importer is responsible for submitting the notification of imported food meeting the requirements (import license for confectionery) to the customs authorities for clearance.

Thank you for reading this article. We hope it helps you understand more about the confectionery import procedures. If you encounter any issues or difficulties during the import-export process, you can choose Real Logistics as your companion. Our team is experienced, honest, and dedicated to each shipment, putting customer benefits first. We guarantee monitoring and ensuring the goods arrive safely in the shortest time and at the most reasonable cost. Please feel free to contact us anytime you need to experience the best service quality!

—————————————

Real Logistics Co.,Ltd

👉 Facebook: Real Logistics Co.,Ltd

☎️ Hotline: 028.3636.3888 | 0936.386.352

📩 Email: info@reallogistics.vn | han@reallogistics.vn

🏡 Address: 39 - 41 B4, An Loi Dong, Thu Duc, HCM City

51 Quan Nhan, Nhan Chinh, Thanh Xuan, Ha Noi City